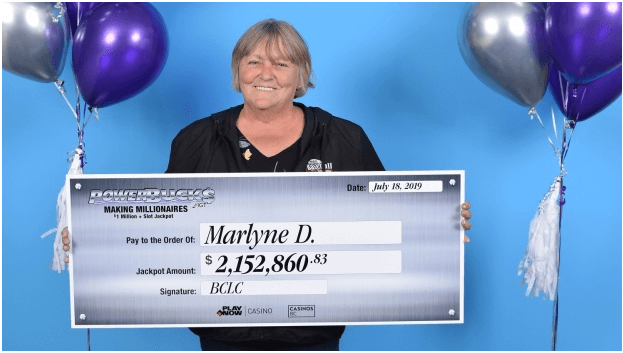

Recently one of the Canadian casino employee was fined $8,000 for failing to pay tax for tips he received from punters in 2011 and 2012. When asked why he failed to disclose the money in his CRA returns, the defendant argued that gambling wins were tax-free.

In August 2019, the Tax Court addressed this issue in a decision involving this slot attendant at the Grand Villa Casino in Burnaby, B.C., who was reassessed by the Canada Revenue Agency for failing to report nearly $24,000 (in 2011) and $39,000 (in 2012) of tips as taxable income on his returns. He was also slapped with gross negligence penalties of $3,059 (2011) and $5,352 (2012) for omitting these tips from his income.

Prior to joining the casino in 1999, the taxpayer was a full-time financial adviser who sold mutual funds and life insurance. Once he began working at the casino, he transitioned to part-time advisory work.

His slot attendant duties included servicing the slot machines, contacting the appropriate casino employees when a patron won and wanted to cash out, showing guests how to use the machines when necessary, and “generally maintaining a friendly, positive attitude in interacting with casino patrons.” The taxpayer was paid an annual salary by the casino of $27,000 in 2011 and $29,000 in 2012.

Click here to read the full story

So are your real money slots wins taxable in Canada?

No your real money slots wins are not taxable in Canada. Gambling income in Canada is tax-free. Whether you play casino games casually or you’re a professional, the CRA does not come after your wins. This includes even the progressive slot wins like the $20 million a Canadian won earlier in March while playing the Mega Moolah jackpot game.

But like the above mentioned Canadian casino employee case if you work in a gambling establishment, your income, including tips are subject to taxation.

Playing real money slots in Canada

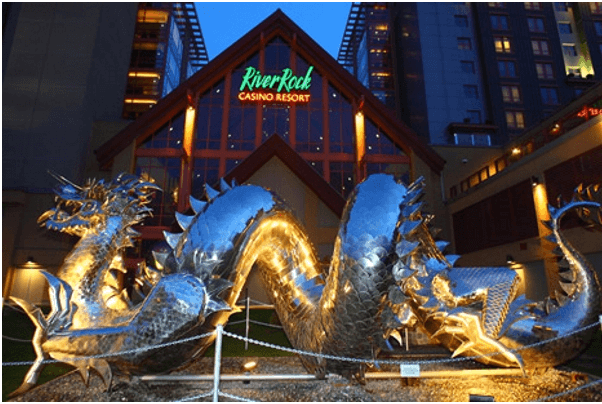

As you visit the real casinos in Canada to play real money slots, you know that these casinos acquire licenses from provincial administrators. Seven out of 10 provinces permit gambling of some form. Ontario is home to at least 25 gambling establishments, making the province with the highest number of licensed establishments.

The Kahnawake National Reserve is also significant in the country’s gambling scene. While most companies struggle to get licensed in the country, investors from the First nations Tribes are allowed to launch casino establishments easier.

When playing real money slots at online casinos which are located offshore or internationally, most casinos with servers in Canada also tend to base them in the Kahnawake reserve. Though Canada doesn’t permit remote gambling licenses except in rare cases, the government also doesn’t prohibit Canadians from gambling on foreign casinos.

This means you can join any online Canadian friendly casino with your cell phone or PC or tablet and play slots, or table games without government interference. If you win money, you’re allowed to keep it without having to pay taxes.

Play real money slots online at regulated casinos

Remember that there are hundreds of online casinos that accept Canadian punters. Not all of them are licensed under Kahnawake Gambling Commission. Many are licensed in the UK with UK Gambling Commission while more are based in Europe and South America. Note that where a casino is established doesn’t matter but it should be licensed under proper gambling authority is what matters. Most of the legit online remote casinos sites are well regulated. The UK, Malta, and Curacao are some of the most prominent online casino regulators. Gibraltar, Isle of Man, Alderney, and Sweden also regulate gambling platforms.

Also you should see that the online casino pays out to you in time; offers 24.7 help support and has fair slots and casino games. Look out for seals from companies like eCOGRA, iTech Labs and Thwate. These companies audit casinos not only for game fairness but also for their security and ability to resolve customer issues.

Finally remember that you will not face any legal action if you are winner at casinos whether pay at real physical venues in Canada or play at online casinos because all the wins are tax free.

But if you are working at any Canadian casino and fail to disclose the gifts or tips that you receive in your tax returns you will have to face the consequences.